The BPIQ Story - History

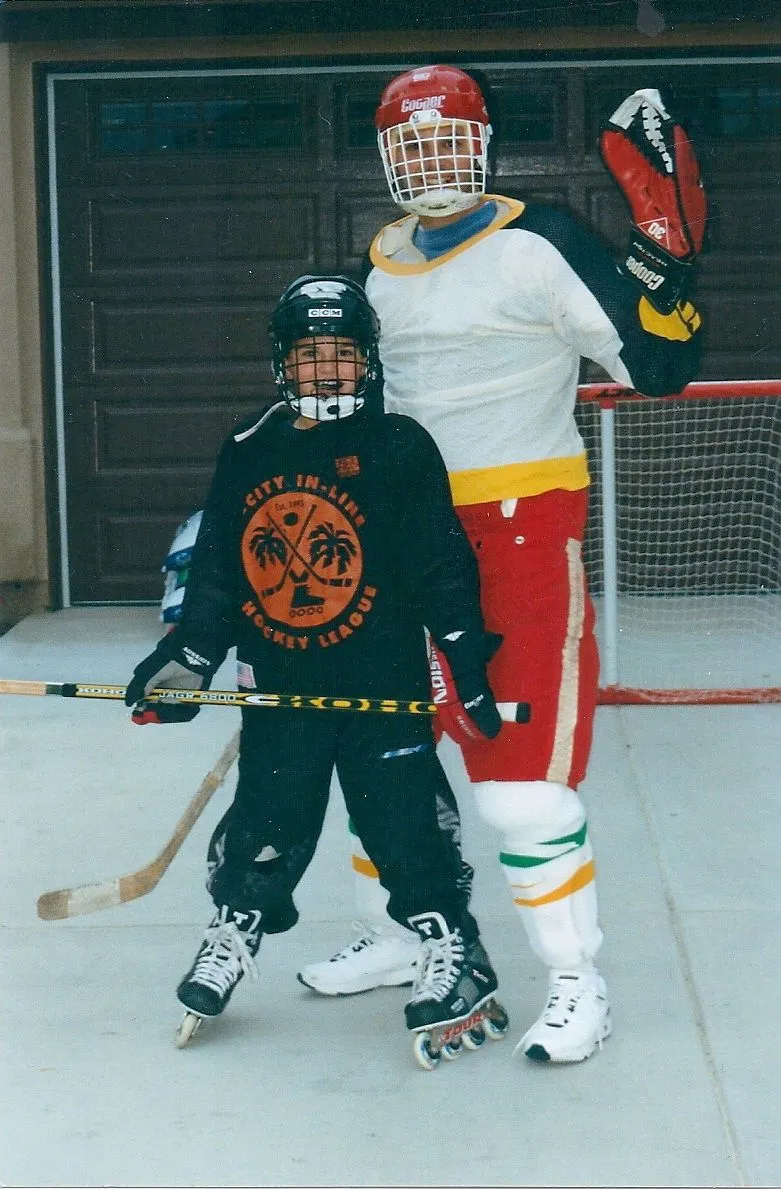

BPIQ is a family-run business, started by father-son duo Manny and Dominic

BPIQ is a family-run business, started by father-son duo Manny and Dominic

~2010s

Since the 1990's, my dad Manny has been investing in biotech companies, after having worked in the industry for many years.

In the 2010's he started Amp Bioresearch, a series of funds focused on investing in publicly-traded biotech companies. In 2018 I joined him alongside his team of analysts to help maintain analyses and biotech data.

Late 2020

We started seriously planning what would become BPIQ. After years of maintaining our own internal company analyses and refining our data processes and management.

January 2021

We launched. It was a basic site: a catalyst calendar, company pages, and pipelines. But it worked. We used it ourselves every day, dogfooding hard, that helped us shape the product.

2021

We stayed heads-down. Building slowly. Trying to improve the product over time. The site was still early but functional. We didn't have much reach so we were sharing useful information in various communities to get our name out there.

2022

We refined and expanded: both the product and the way we showed up online.

Later that year, things clicked. We hit a groove. We shared useful biotech content more consistently. We rebuilt the website and launched a stronger web application with more actionable data for investors.

2023

We kept the momentum going. We grew into a global team. Our operations and processes improved a lot. We doubled down on what worked, and tried to trim what didn't.

This year we also launched an adjacent product, BiopharmIQ, focused on helping sales and BD teams in biopharma. We started small, offering curated monthly company lists.

We also found our community. Biotech investors on X/Twitter who shared deep insights, useful analysis, and appreciation for our data. Since then, we've grown a bio-X/twitter community of >25k - (here's that story).

2021–2023: Market Context

Biotech was in a tough spot. The macro backdrop was rough, $XBI trended down for most of this stretch. But we kept building.

Even in a cold market, investors still needed tools and data. We kept showing up with both.

2024

Biotech didn’t boom, but it stopped bleeding. The market moved sideways, not great, not terrible.

We expanded both BPIQ and BiopharmIQ. We brought on a software engineer to join the team, a big help for me personally.

2025 (So far)

This year started choppy again. $XBI still feeling heavy. But we’ve stayed steady.

We’ve started doubling down on how AI fits into our workflows. We're being intentional with how we use it, and where. We don't blindly rely on it but use it as a very promising tool.

BPIQ started as a tool we built for ourselves.

Now it’s used by biotech investors and teams across the industry, from hedge funds to startups to individual traders.

It’s still just the beginning. But we built something special, a useful product, a growing community, and a powerful team.

Thanks for following along.

-- Dom